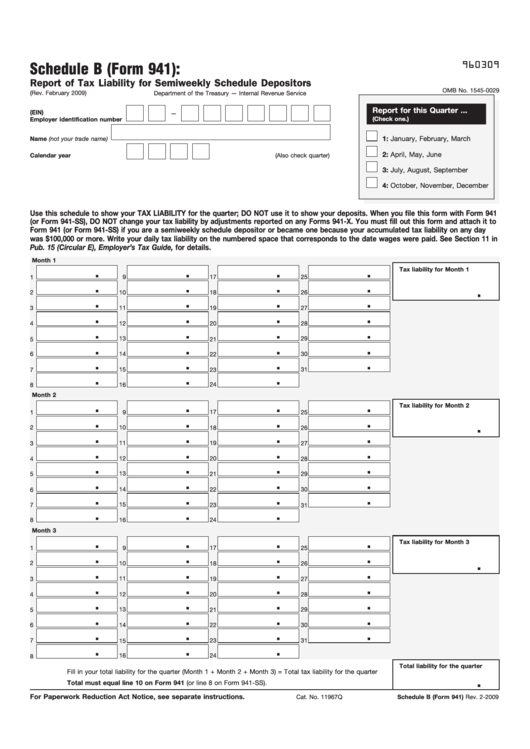

941 Form Schedule B - Web form 941 schedule b is used by the irs to check if employers have deposited their employment tax liabilities on time. Web schedule b is a report of tax liability for semiweekly schedule depositors. Web form 941 is used by employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks. It shows the federal income tax, social security and. Therefore, the due date of schedule b is the same as the due date for the.

Web schedule b is a report of tax liability for semiweekly schedule depositors. Therefore, the due date of schedule b is the same as the due date for the. Web form 941 schedule b is used by the irs to check if employers have deposited their employment tax liabilities on time. It shows the federal income tax, social security and. Web form 941 is used by employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks.