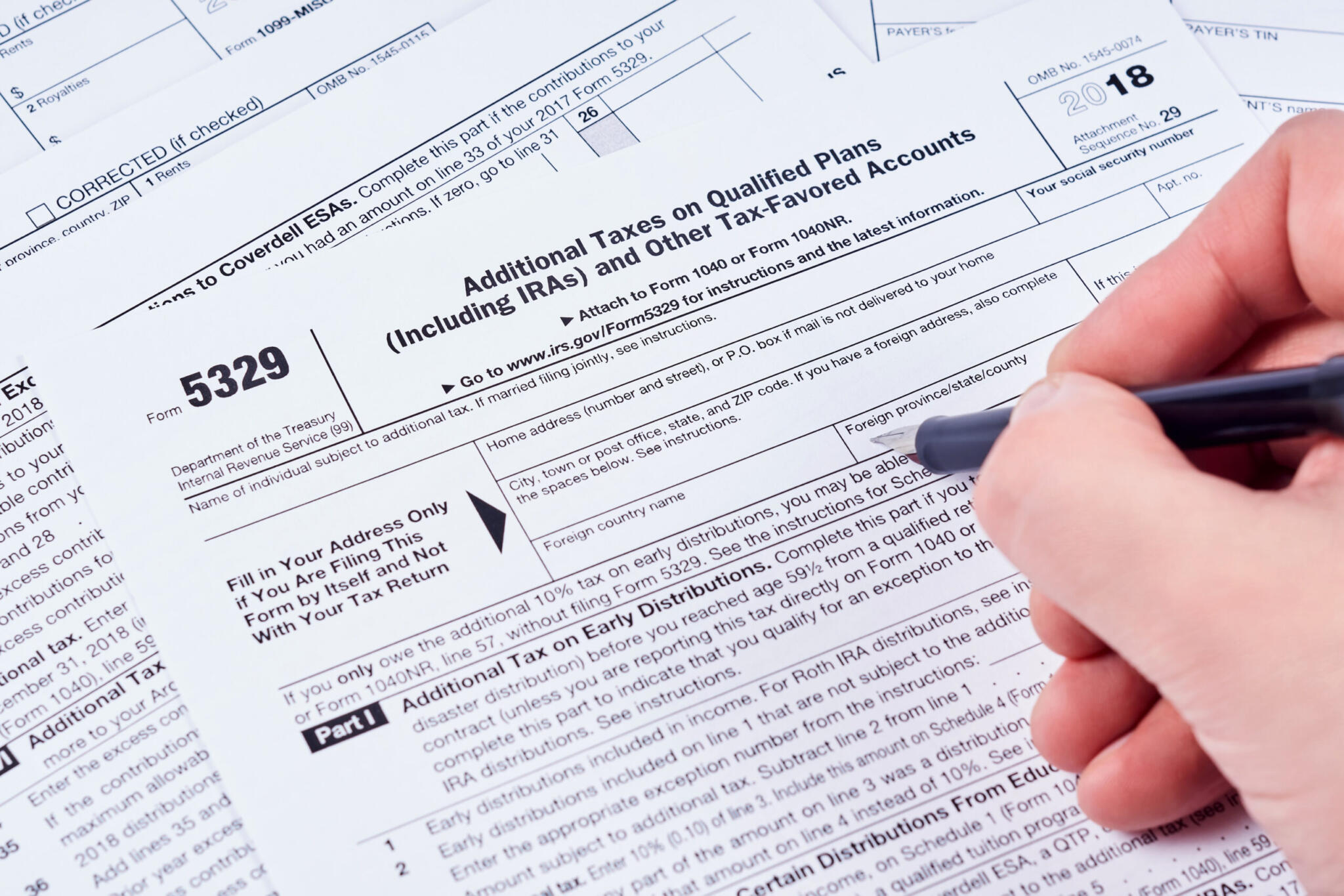

Form 5329 Exceptions - Web understanding exceptions to form 5329, additional tax on early distributions by intuitupdated december. Web form 5329 exceptions to early withdrawal penalty codes are: Web you received a distribution subject to the tax on early distributions from a qualified retirement plan (other than a roth ira) and. 01 — distributions from a qualified retirement plan (not an ira) after.

Web form 5329 exceptions to early withdrawal penalty codes are: Web understanding exceptions to form 5329, additional tax on early distributions by intuitupdated december. 01 — distributions from a qualified retirement plan (not an ira) after. Web you received a distribution subject to the tax on early distributions from a qualified retirement plan (other than a roth ira) and.

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)